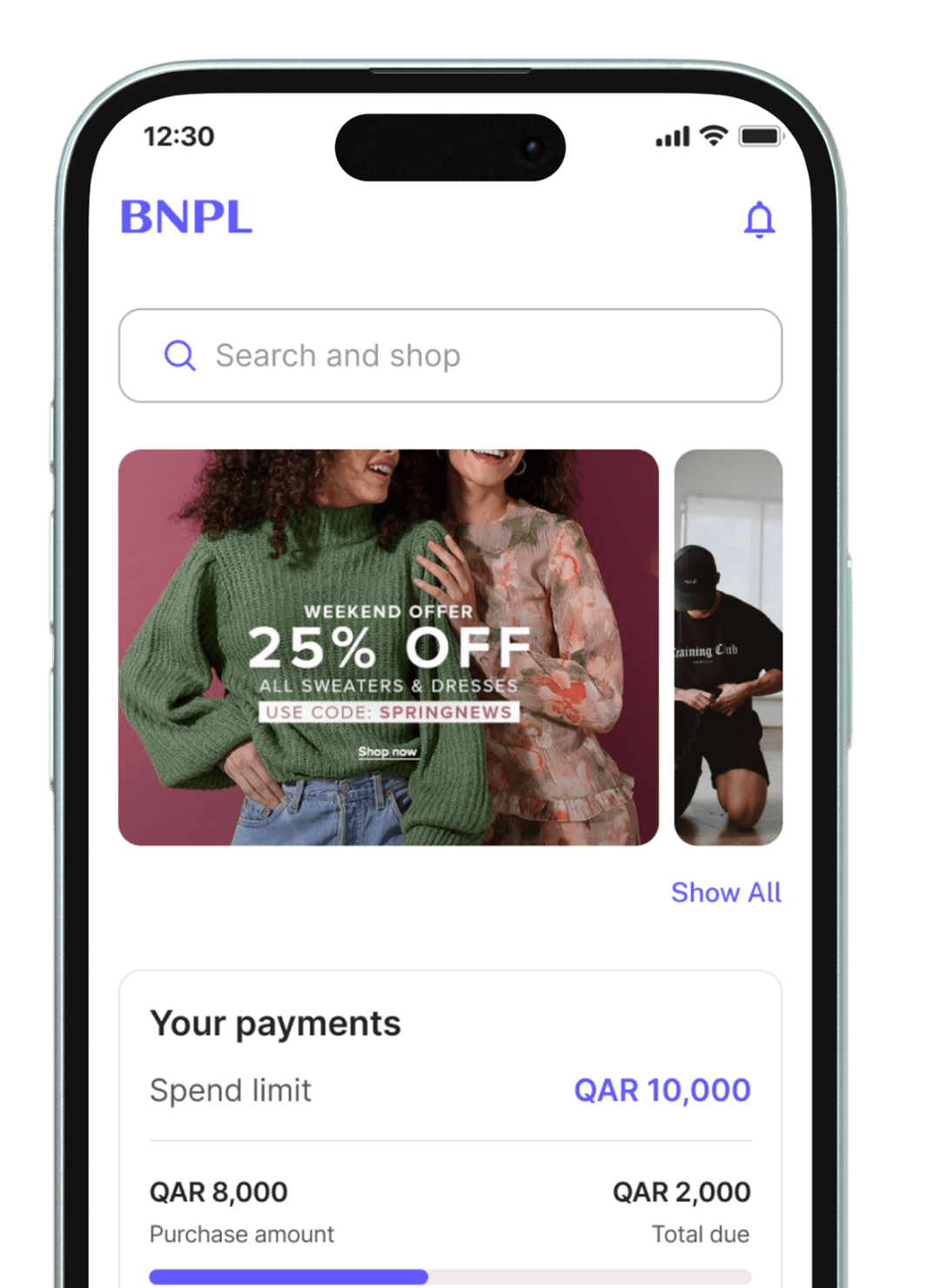

Buy Now Pay Later (BNPL) – PayLater Platform

Enable customers to split purchases into manageable installments while you earn more and manage risk better.

Next-gen BNPL for smarter payments

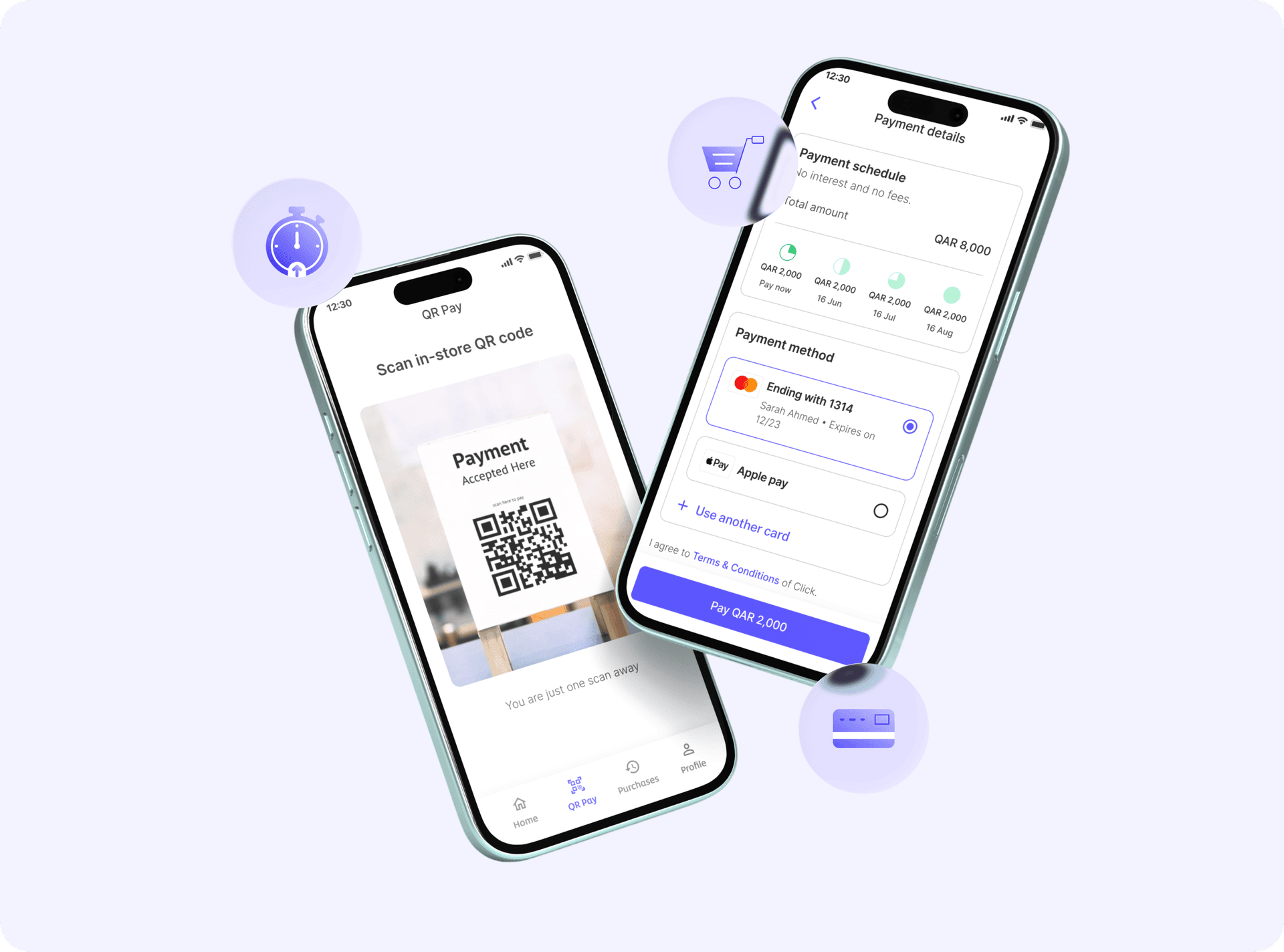

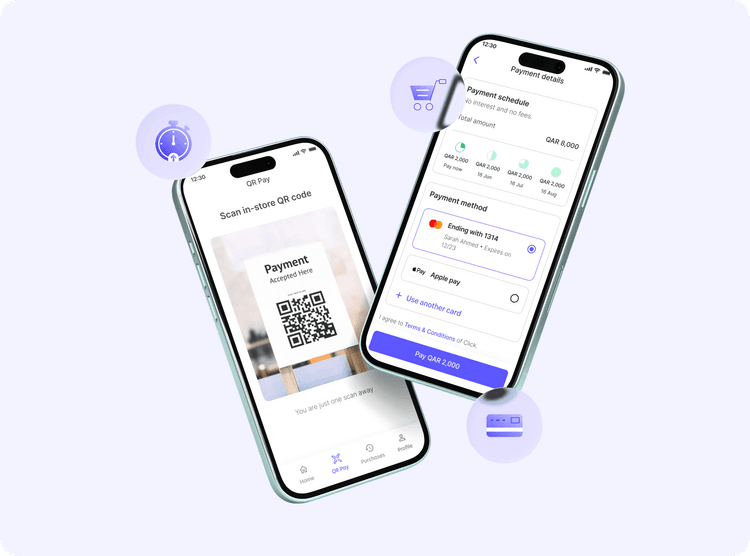

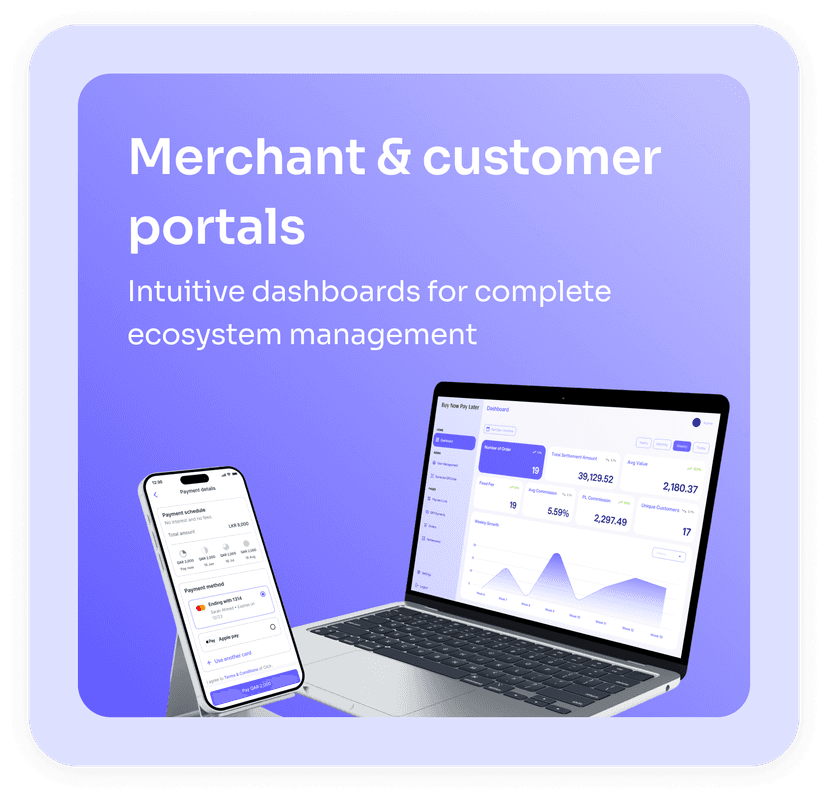

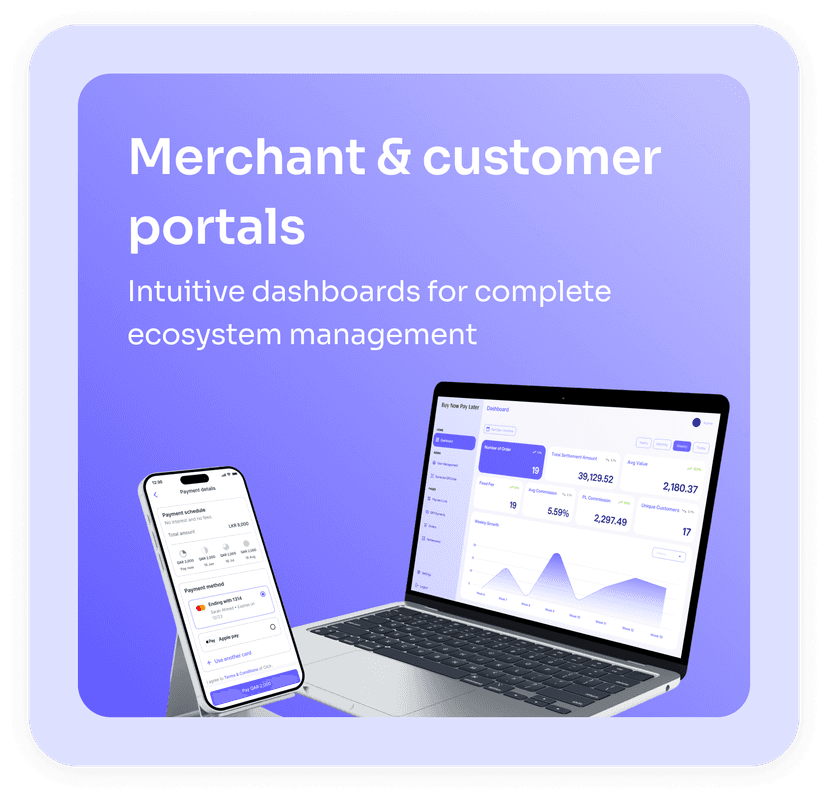

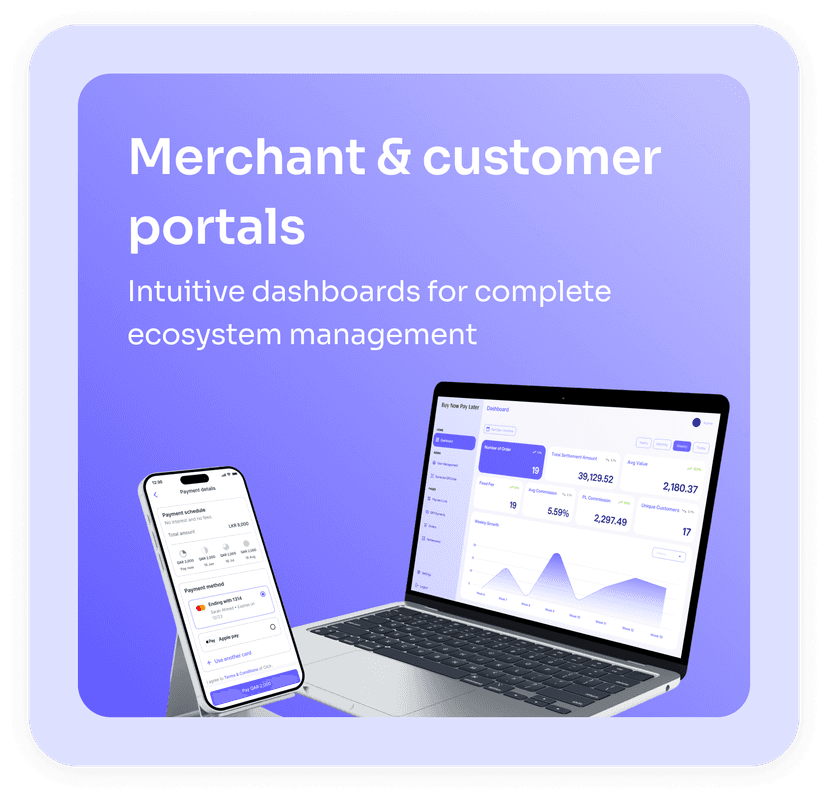

PayLater by Arimac is a next-gen BNPL solution built for financial institutions and consumer platforms. It allows merchants and banks to offer deferred payments via card-based, direct debit, or QR-based channels. Backed by robust scoring, dynamic risk management, and intuitive UX, PayLater is live in Qatar and expanding across the GCC and Asia.

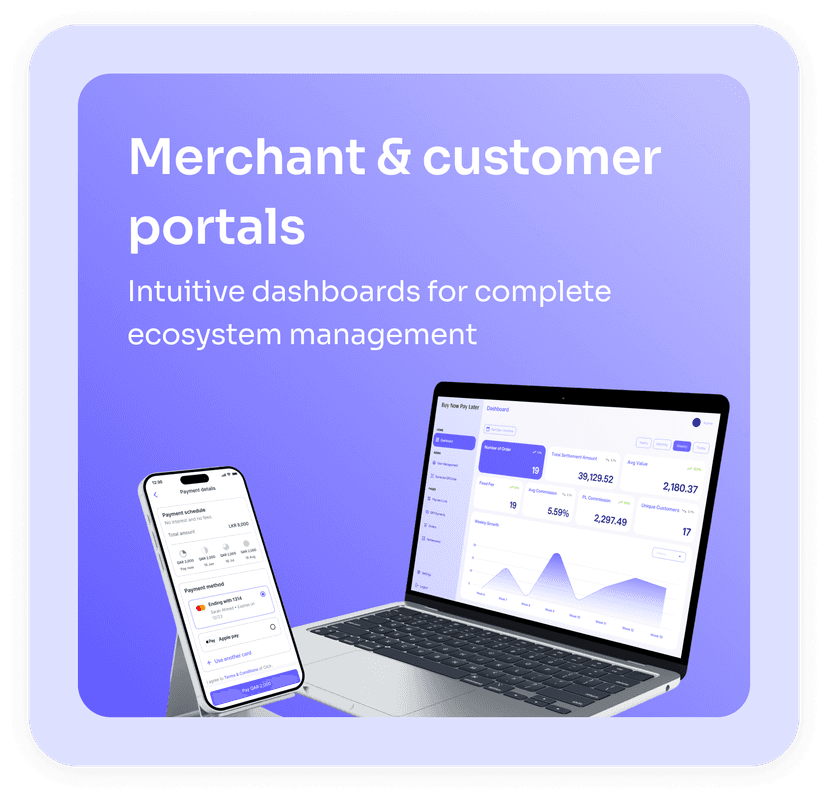

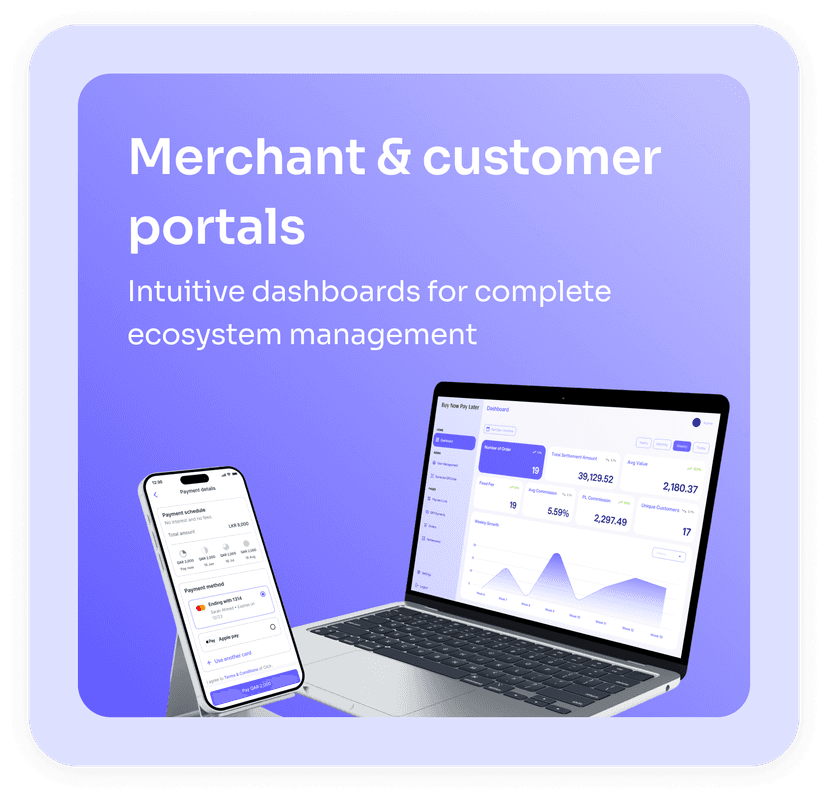

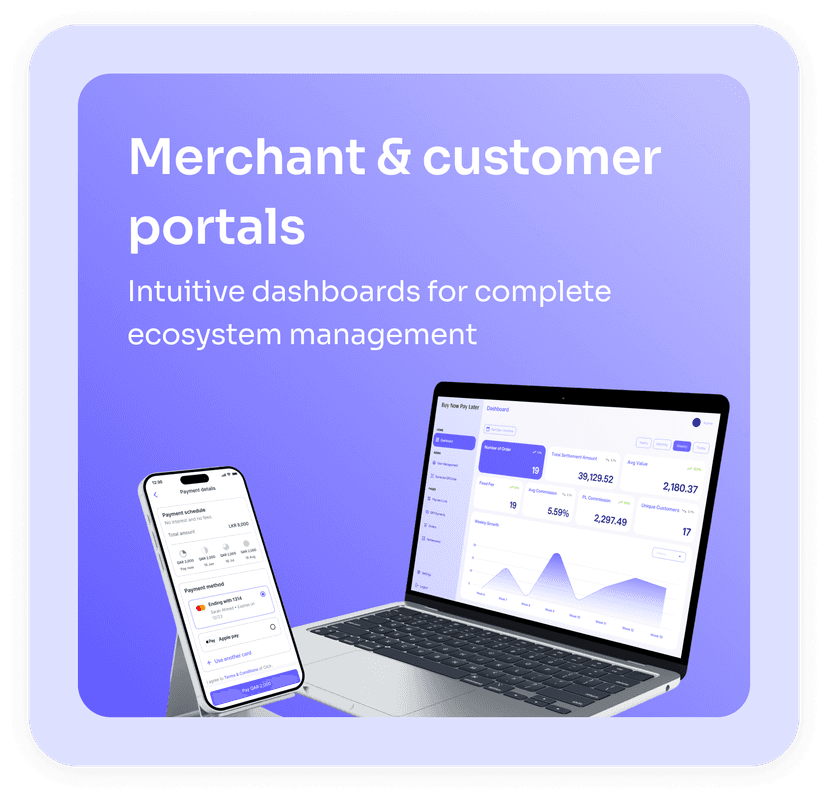

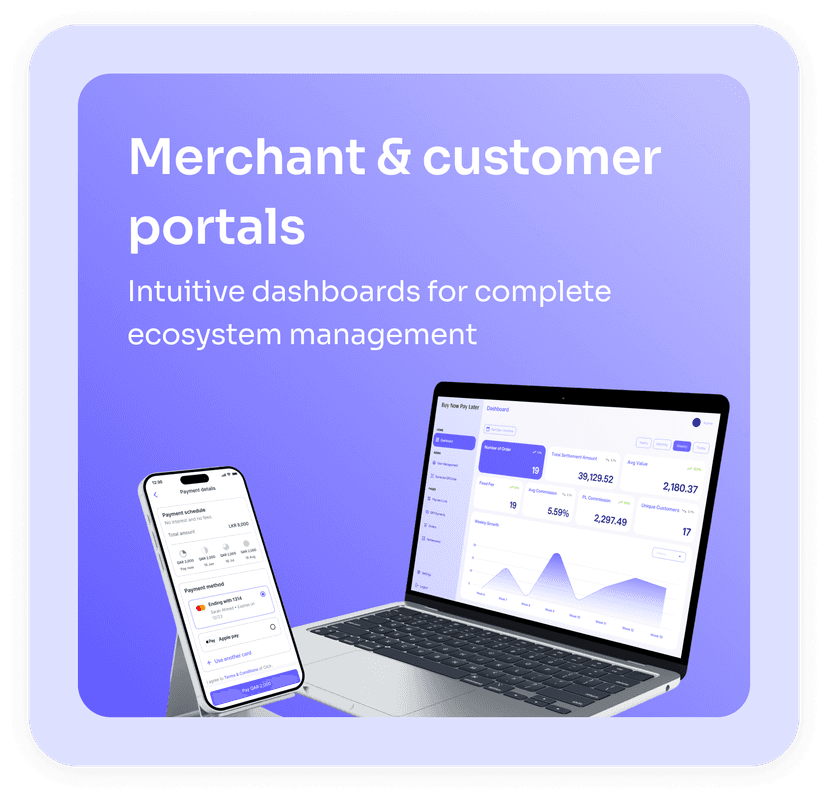

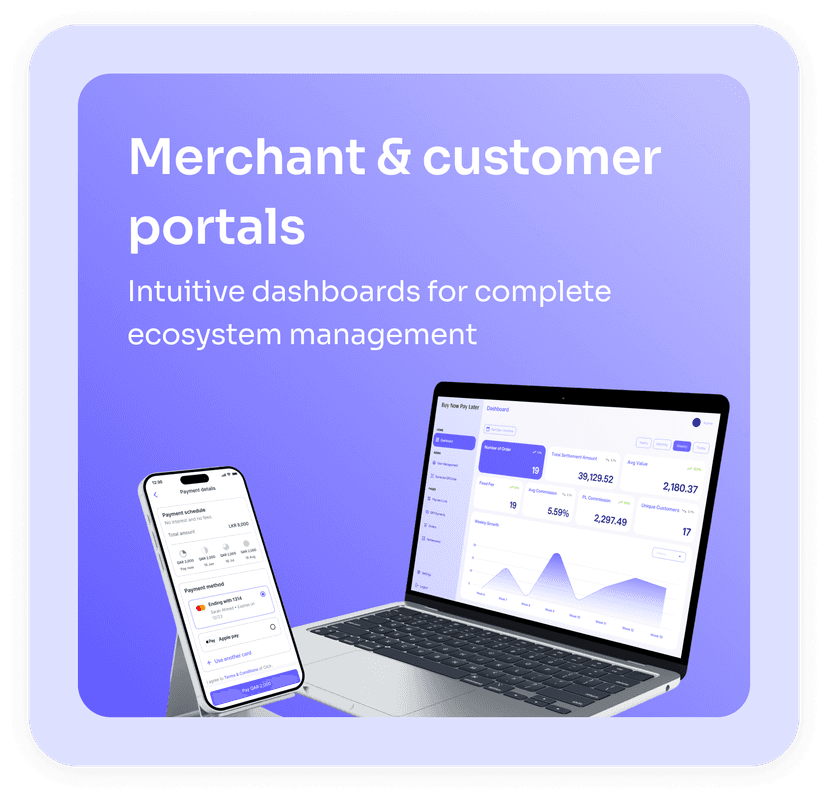

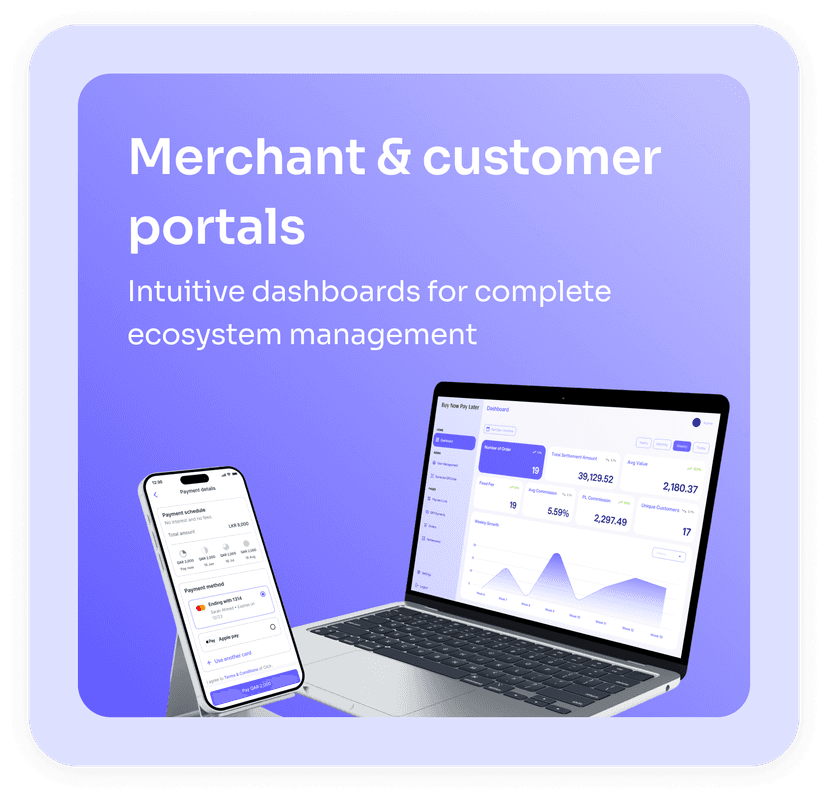

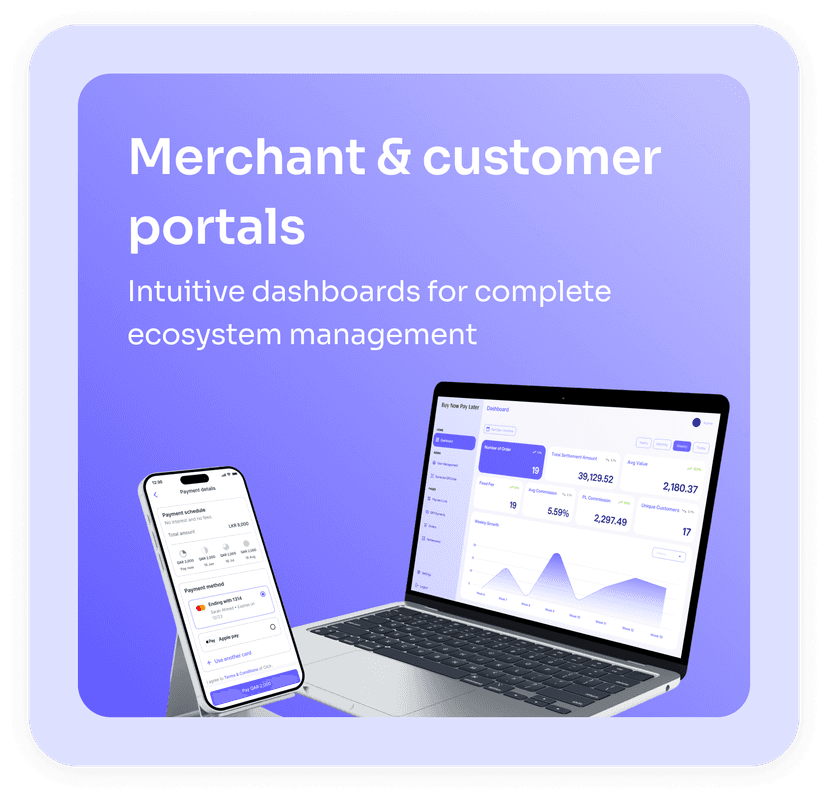

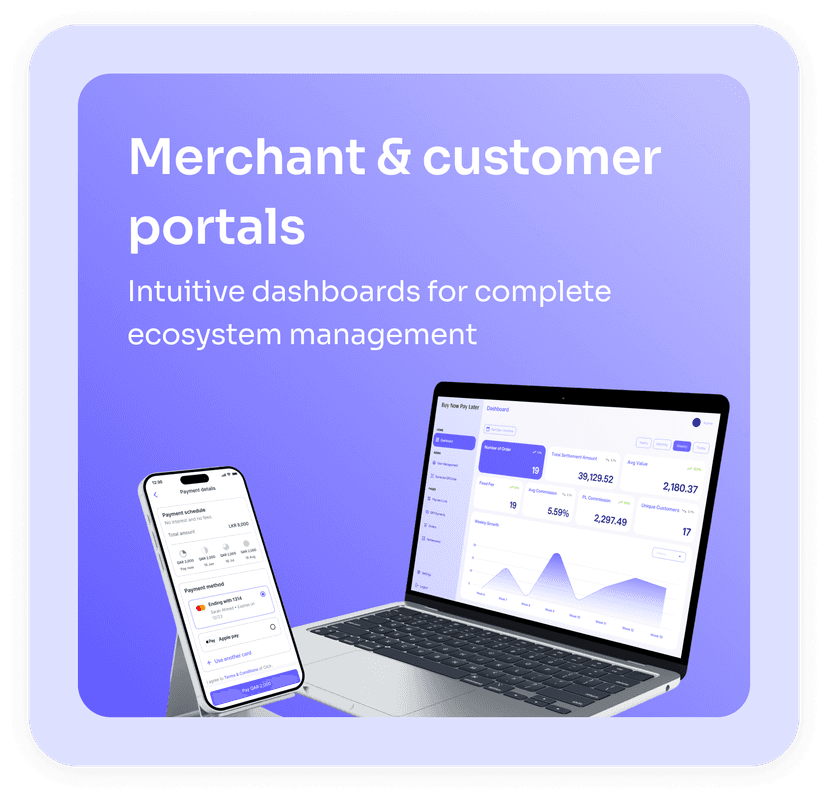

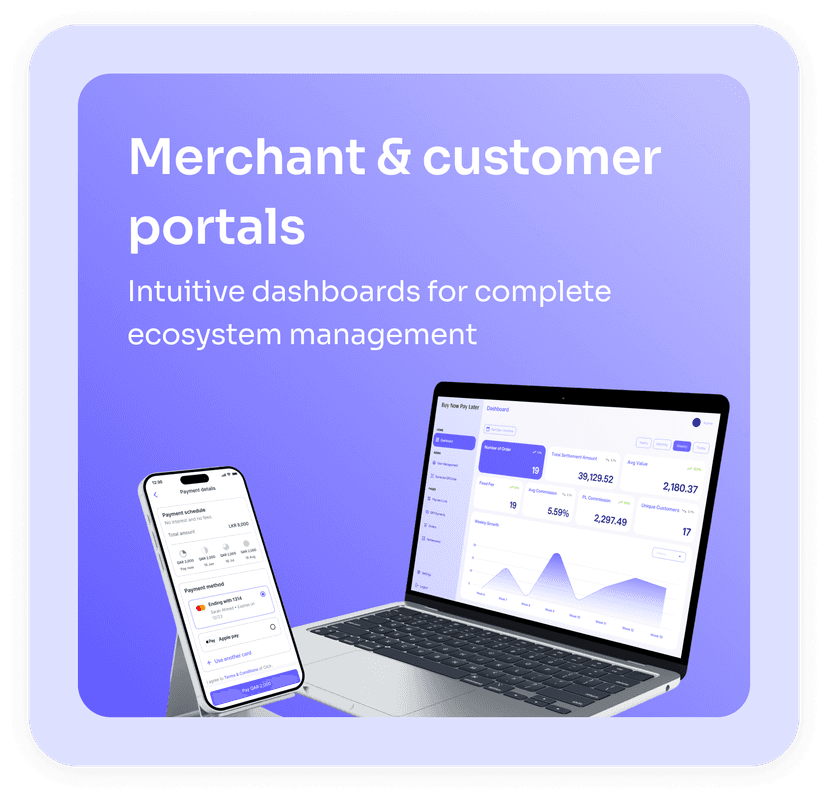

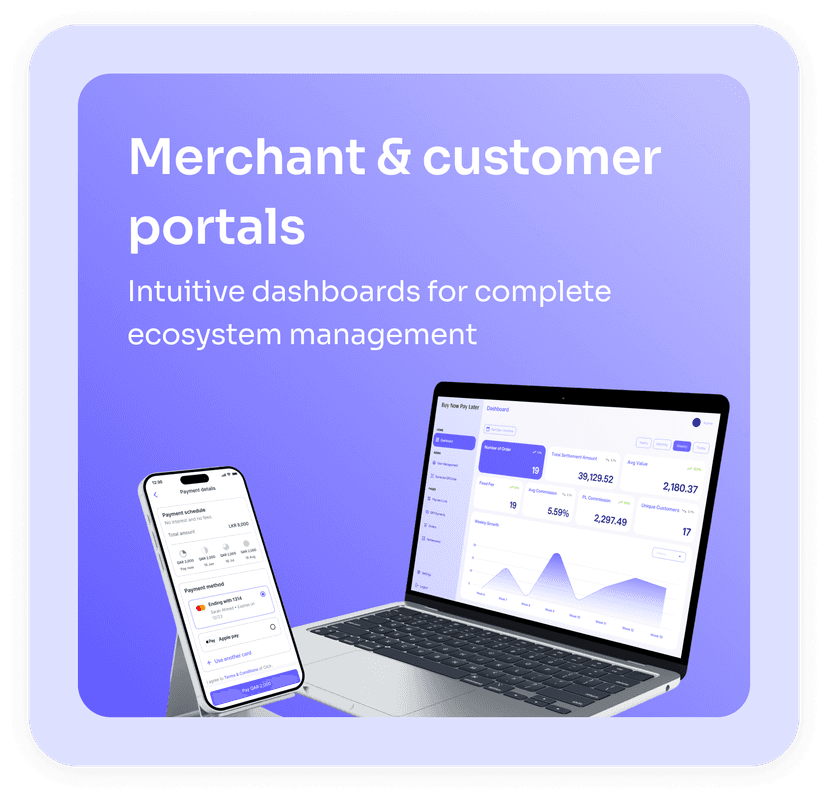

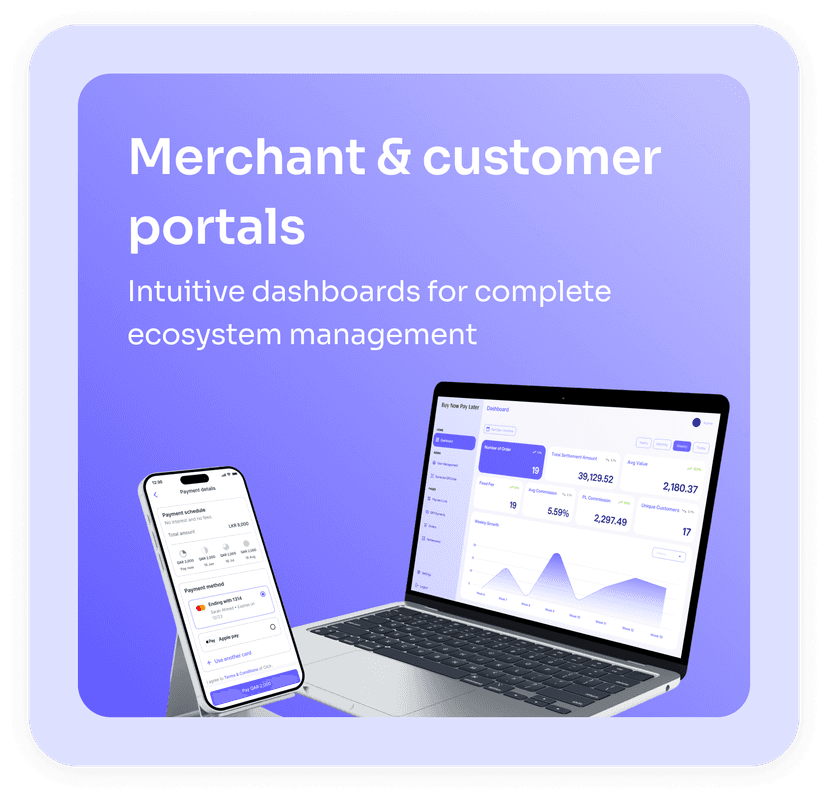

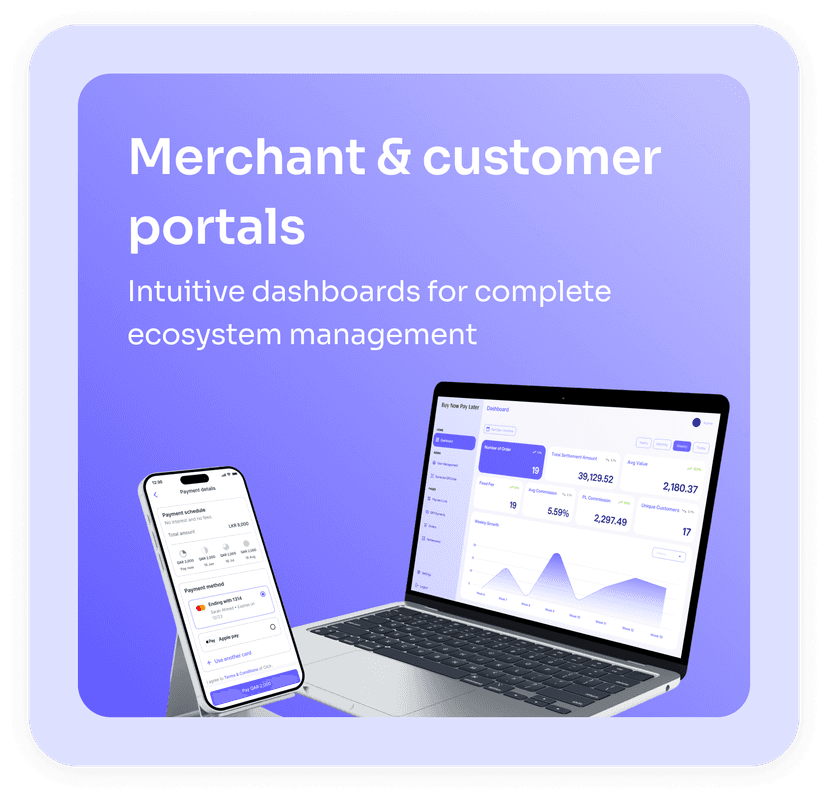

Built for modern financial ecosystems

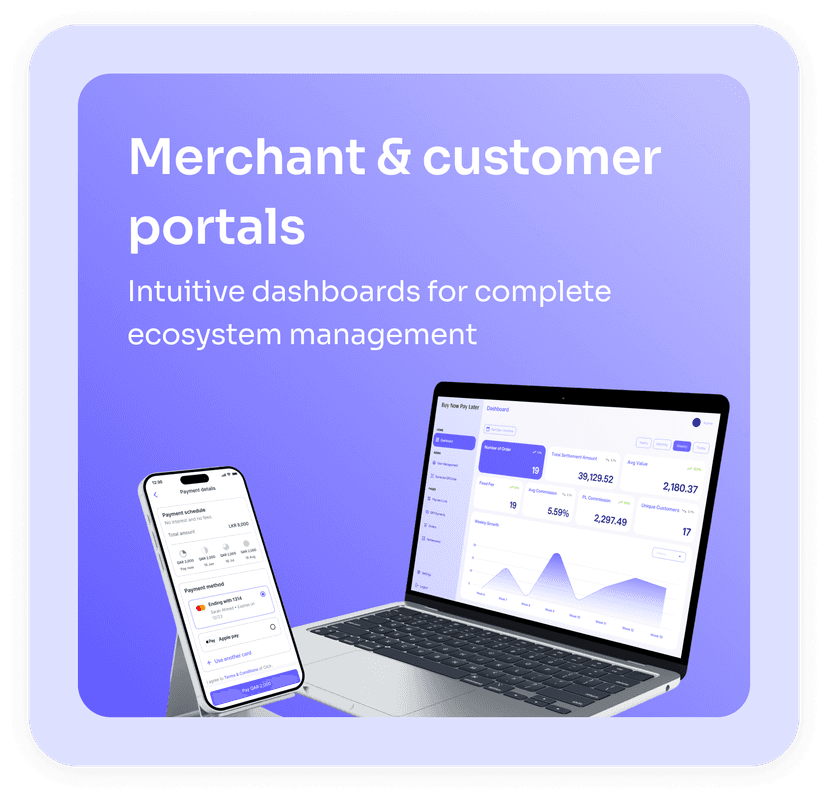

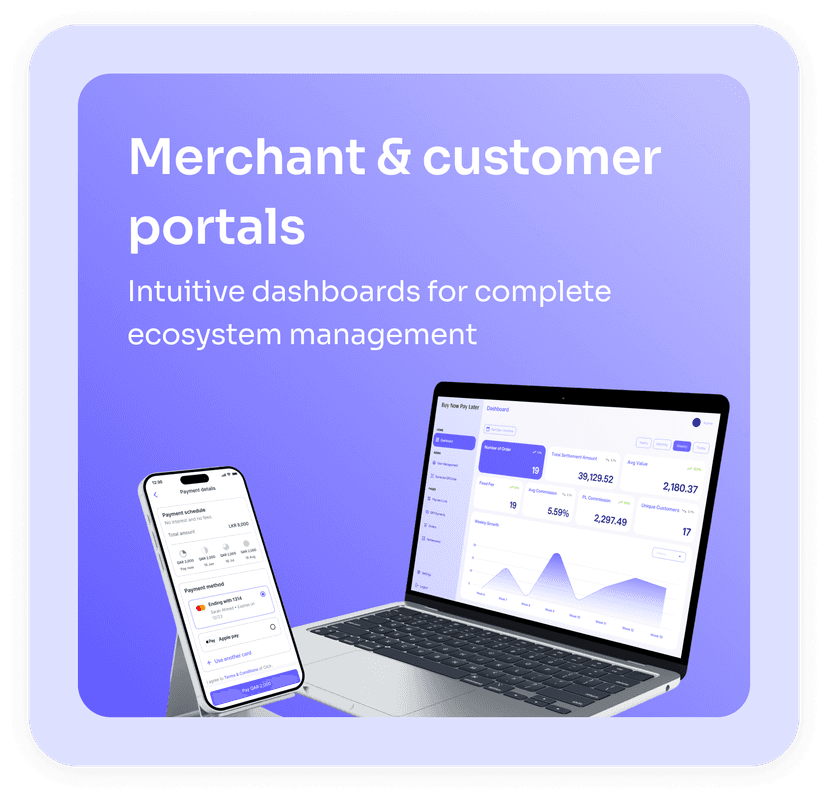

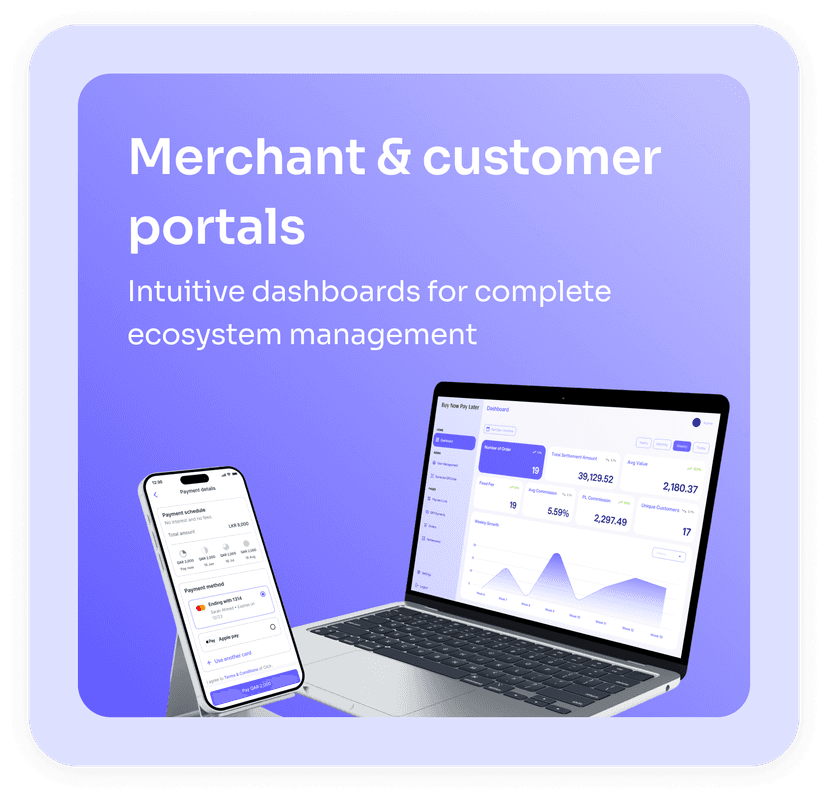

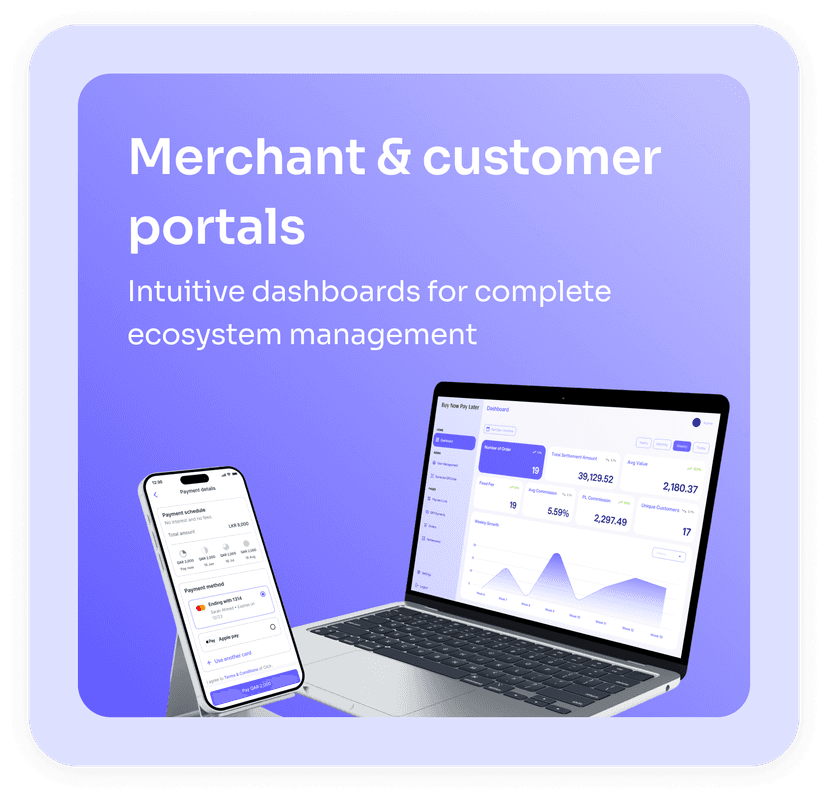

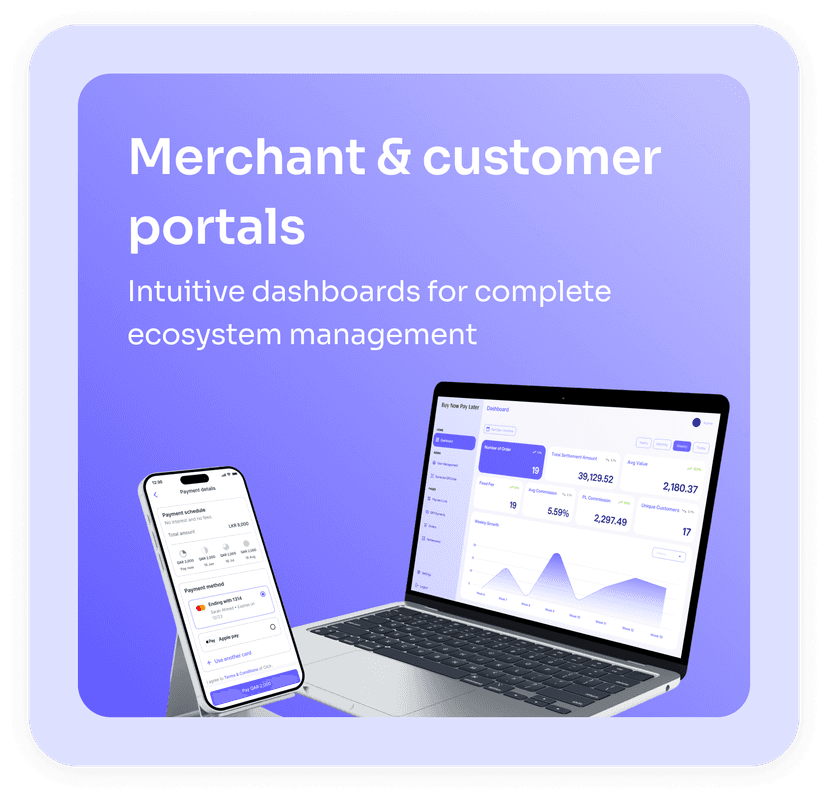

PayLater connects banks, merchants, and fintech partners through seamless APIs and user-first interfaces, making it ideal for a range of industries.

Audience list:

- Retailers and e-commerce

- Telecom providers

- Insurance and education providers

- BNPL enablers and fintech partners

Next-gen BNPL for smarter payments

PayLater by Arimac is a next-gen BNPL solution built for financial institutions and consumer platforms. It allows merchants and banks to offer deferred payments via card-based, direct debit, or QR-based channels. Backed by robust scoring, dynamic risk management, and intuitive UX, PayLater is live in Qatar and expanding across the GCC and Asia.

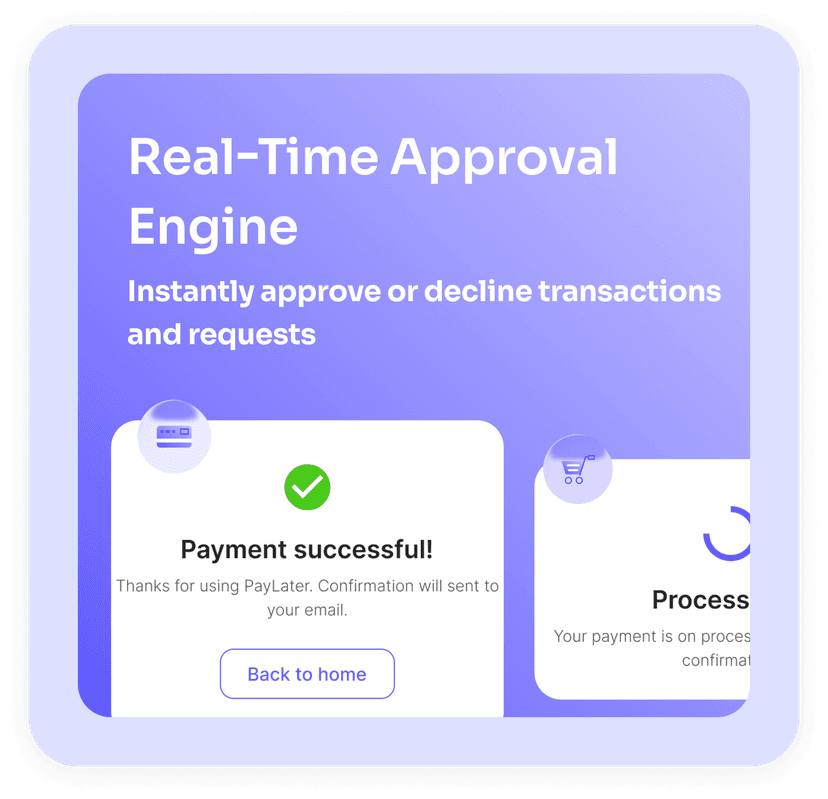

Discover the key features

Built for developers. Secured for scale.

Integration & Sandbox

Merchant SDKs for iOS, Android, Flutter, React

Open API documentation with Postman collection

Webhook and settlement event triggers

Architecture & Security

Microservices-based with containerization (Docker, K8s)

GCP / Private Cloud deployment-ready

Fully PCI-DSS & OWASP compliant

PKI-enabled data encryption

Keycloak-based IAM

Future roadmap

Save Now Buy Later

Loyalty integrations

Integration with ride-hailing and delivery apps

Risk & financial wellness scoring tools

Apple Watch, Huawei Wearable support